I am sharing with you some of the information the Life Insurance Marketing and Research...

Policy tightening from the Fed pushed yields on cash-like instruments to their most attractive levels in over a decade. With yields around 5% and minimal risk, CDs (as in Certificates of Deposit) are back with a vengeance, but should you buy into the hype? The answer to that depends on a variety of factors like time frame, risk tolerance, long-term goals, and more. Let’s explore …

At Virtus Wealth Management, we believe CDs are best used to support short-term savings goals. CDs have fixed rates, guarantees, predictable returns, and their terms typically range from three months to five years, so they can be tools to set aside savings for future purchases within a specific time period. What’s not to love?

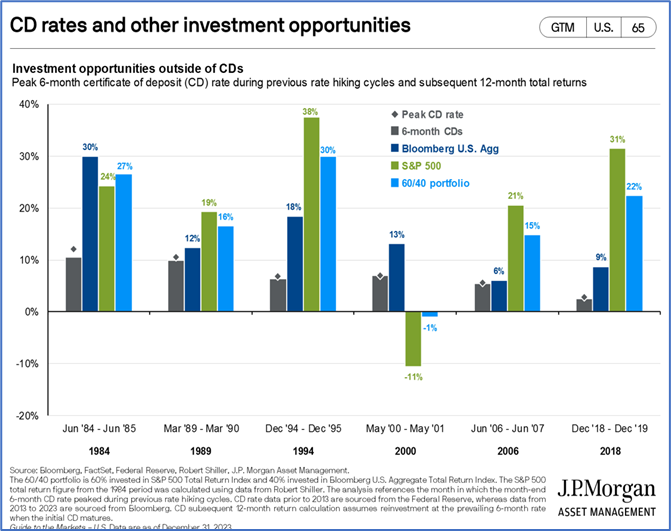

The chart below illustrates that CDs are more for short-term safety than long-term growth. History shows that staying parked in cash after the peak in interest rates usually leaves money on the table (opportunity cost). In the last six rate hiking cycles, the U.S. Aggregate Bond Index outperformed cash over each of the 12-month periods following the peak in CD rates, while the S&P 500 and a 60/40 stock-bond portfolio outperformed in 5 of these periods.

This is not to say that investors should abandon cash altogether, as liquidity is an important allocation of any portfolio. The timeframe for the use of that liquidity is what’s important. At Virtus Wealth Management we believe there is an opportunity cost in holding onto too much cash (even in CDs) for long-term money and advocate putting long-term money into long-term assets. Following a peak in interest rates there has consistently been a better asset than cash to deploy capital. If you have any questions or would like some guidance specific to you, please contact us. We are here to help.