I am sharing with you some of the information the Life Insurance Marketing and Research...

There are no absolute truths when it comes to investing and your finances. There is no rule book of set instructions that would financially benefit every person at every stage of his or her life. Here is where we can help.

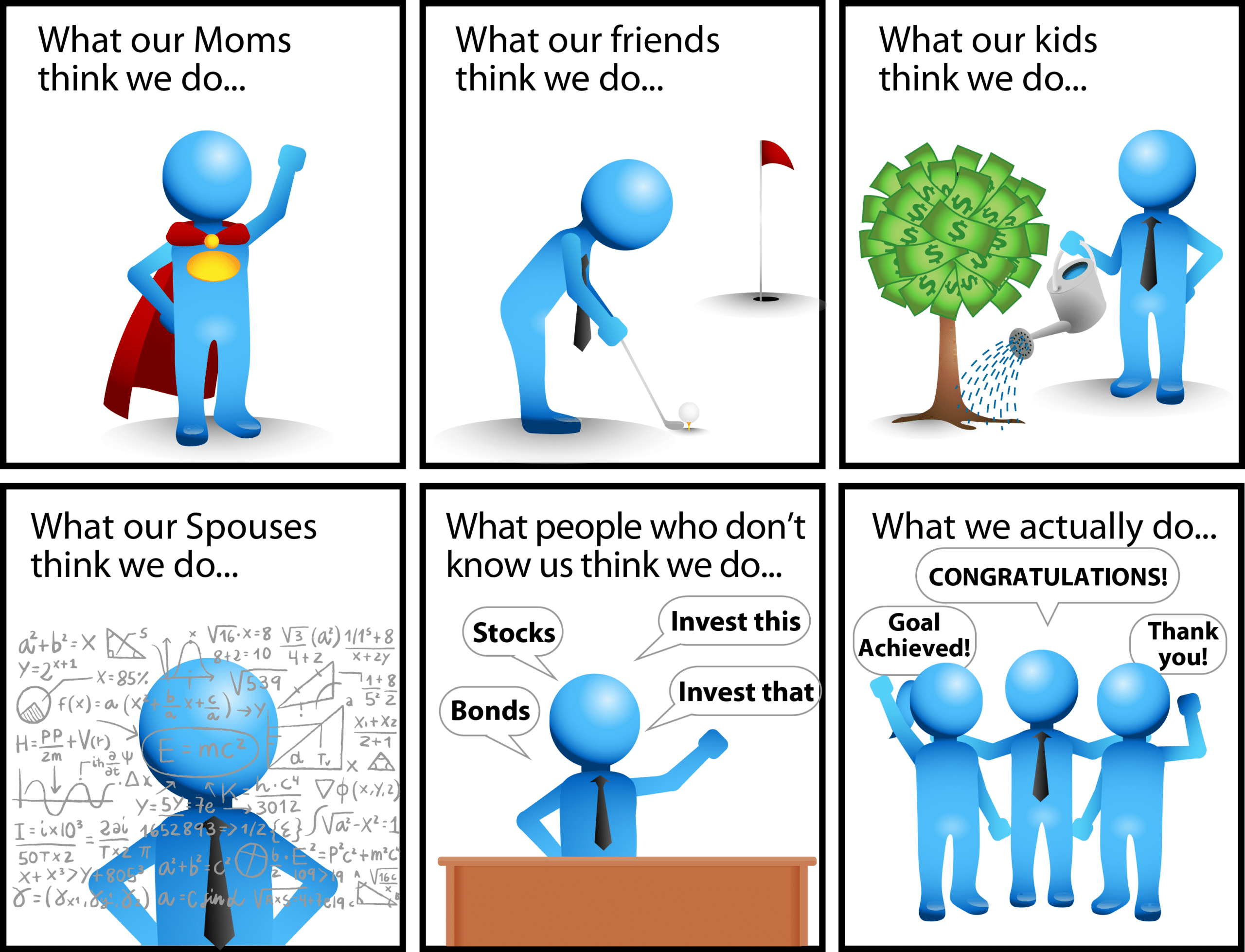

What we do as financial advisors is help people, just like you, strive to achieve the milestones in life that they have been dreaming of and working toward. Are you saving to buy your first home or first car? Are you trying to decide how to save for your children’s’ college education while you’re still making payments on your own student loans? Have you recently changed jobs and received new employee benefits you want to maximize? Maybe your focus is planning your estate, saving for retirement, and laying the ground work for your legacy? Or you’ve already retired? Not everyone is working to achieve the same milestones and this list is by no means all-inclusive.

Ultimately, mutual trust is the key to a successful relationship between you and your advisor. It is important that your financial advisor truly knows your life, your family, your goals and anything else that makes you, you.

This is because successful wealth management extends beyond investment advice and asset management. A truly comprehensive financial advisor will look at the big picture of your financial life so we can assess all the factors that affect your unique situation. You benefit by coordinating and unifying the decisions in your financial life so that those decisions complement each other and work to produce enhanced results. This is what we refer to as maximizing the efficiency of your wealth.

Money inefficiencies can occur in all areas of your finances. They erode wealth and can limit us from building sustainable long-term wealth. These eroding factors include taxes, inflation, market risk, accidents, disability, death, and lawsuits. A common example of money inefficiency that we see has to do with an overlap of coverage between homeowners’ insurance and umbrella insurance. Many people can lower their monthly premium payments by making sure you are not paying twice for the same coverage.

In regards to your finances, you likely work with many different professionals including your banker, real estate agent, attorney, accountant, life insurance agent, etc. Each of these professionals typically focuses on their small part of your wealth management plan. But how do you know that an action or recommendation from one professional works efficiently with the actions of another?

A fragmented approach like this enables important key components to be missed that could affect not only the right approach to take regarding your finances but also the outcome. This is inefficient, inconvenient, and expensive for you, especially in the long run. It also lacks accountability and consistency.

You can benefit by bringing everything together under the oversight of one professional: a financial advisor. This professional assistance can provide you a more streamlined, efficient, consistent, and convenient process. Here at Virtus Wealth Management, we have a tried-and-trusted process in place to ensure that you have a plan that is organized and coordinated to help pursue your goals.

Your financial advisor will partner with you to build a tailor-made plan that you are confident in. Why is planning so important? Per a Palo Alto Software study in 2016, a business is twice as likely to be successful if it has a written plan. Your financial future is not unlike a business, and not to be cheesy, but you are the CEO. If you hypothetically had an idea or business that you sincerely believed in, would you just leave it to luck and assume the finances would figure themselves out later? This would not be the most effective option. Instead, seek the guidance of a professional financial advisor with experience, who can help you establish a written plan to pursue your milestones, update that plan as your life and goals change, and ultimately maximize the efficiency of your wealth.

The essential components of a holistic wealth management plan include, but are not limited to, investment management, retirement planning, goal-based planning, tax planning, risk management, and estate management. You can find more information on our holistic approach to wealth management, here.

With your holistic wealth management plan, you will know exactly where you are and what it takes to pursue your goals. It is not a tool solely for the use of your financial advisor but rather a resource for you to reference for years to come.

If there is one thing that is constant in life, it’s change. There are “seasons” of life just like seasons of the year. However, the “seasons” of life are different in that there is no predetermined date or age that someone automatically shifts “season,” or life stage.

It does not matter what age you are, what life stage you are in, or how much money you are working with. You can benefit from having a professional, written wealth management plan.

Once you have established your wealth management plan to pursue the milestones you are reaching for, update that plan as your life and goals change in order to ultimately maximize the efficiency of your wealth.

Your plan and goals should be reviewed annually at a minimum. This is why our advisors perform multiple reviews annually with our clients. These meetings help to keep you, your goals, and your team of professionals connected and on track. We pride ourselves on having built a team of financial advisors with knowledge in different aspects of wealth management that complement each other. So as a client of Virtus, you will partner and work with one of our advisors who truly gets to know you, your life, and your goals, while still having access to the expertise our other financial advisors provide.

As a client of Virtus Wealth Management, you join a community of individuals who are, or want to be, educated, empowered, and involved in the planning of their financial futures. This is a community of individuals who are smart enough to take control of their financial future and establish a partnership with Brian, Chuck, Karen or Mark. Through this partnership, we provide you the means to actively participate in a holistic approach to your finances that allows you to maximize the efficiency of your wealth.

If you are seeking a financial advisor, we want to invite you in to our office for a complimentary consultation so you have the opportunity to get a better understanding of who we are and what we can do to help you and your specific situation.

Contact us to get started today.

We also provide more information in our Virtus View – a newsletter we send via email twice each month. For the latest investment insights, tips, and strategies to help you live your best financial life, you can sign up to receive this newsletter at the bottom of this page. In addition, past Virtus View articles can be read here on our blog.