I am sharing with you some of the information the Life Insurance Marketing and Research...

Retirement planning is one of the key areas of knowledge at Virtus Wealth Management. We like to help our younger clients plan (starting in the first or second quarter of their life), in general, but inevitably we get new clients that are closer to retirement (third quarter of their life) too. This is where retirement planning really kicks in and can be a key driver of success during the retirement years.

There are several areas of retirement planning that stand out including –

Very few people reach a fulfilling retirement by accident. It’s intentional. It requires analysis, a plan, and execution. We are here to help.

Establishing goals can be difficult, but the closer you are to retirement the more specific you need to be to enable you to get specifically where you want to go. We use a process that works with ranges, and we talk in today’s dollars for a consistent frame of reference.

First, we discuss spending. We ask our clients how much they would like to “ideally” be able spend per month or year in today’s dollars. Then, we ask what the “acceptable” version of that would be. This gives us the spending range. It is very, very important to understand your spending prior to entering retirement.

Next, we discuss retirement age and, again, we work in ranges. “Ideally” when would you like to retire? What’s an “acceptable retirement” age? Do you want to semi-retire, like a second, less stressful career or to work part-time? At what age would you like to do that?

Finally, we discuss legacy thoughts. Legacy thoughts revolve around what you want to leave behind when you are gone. Some of our clients want to spend everything before they go. Some of our clients want to leave a substantial amount to their heirs. Some of our clients are in the middle, and some of our clients don’t care — whatever is left is left. Again, if you have a legacy goal, we discuss it in ranges (“ideal vs. acceptable”) and in today’s dollars to keep it real.

It’s important to understand that we have a lot of experience with goal setting. Just like Farmers Insurance, “We know a thing or two because we’ve seen a thing or two”. We can use our experience to help you formulate your goals and guide you to reaching them.

This is where we take a very close look at your Retirement Income sources and determine how to best use them. A good example of this is Social Security. Social Security Planning can be a key part of success in retirement. Should you take it early, on time, or delay until 70? If your married, does your spouse have their own social security record? Should you take one early and one later? How is social security impacted when one of you passes away? All good questions that need to be addressed in the Social Security part of your Retirement Plan.

Do you have a Pension, Annuity, and/or IRA? When is the best time to start taking money from those? When are you “required” to take money from each of those and what are the tax implications?

If you retire “early” (prior to 59.5 years old), where are you going to get your income? Do you have an after-tax bucket that you plan to access? If so, is this a good time to consider a Roth Conversion? How can Roth Conversions help in retirement and/or to reach your Legacy Goals?

Again, these are all good questions that need to be addressed and are covered in the Retirement Income Strategy portion of our Retirement Planning process.

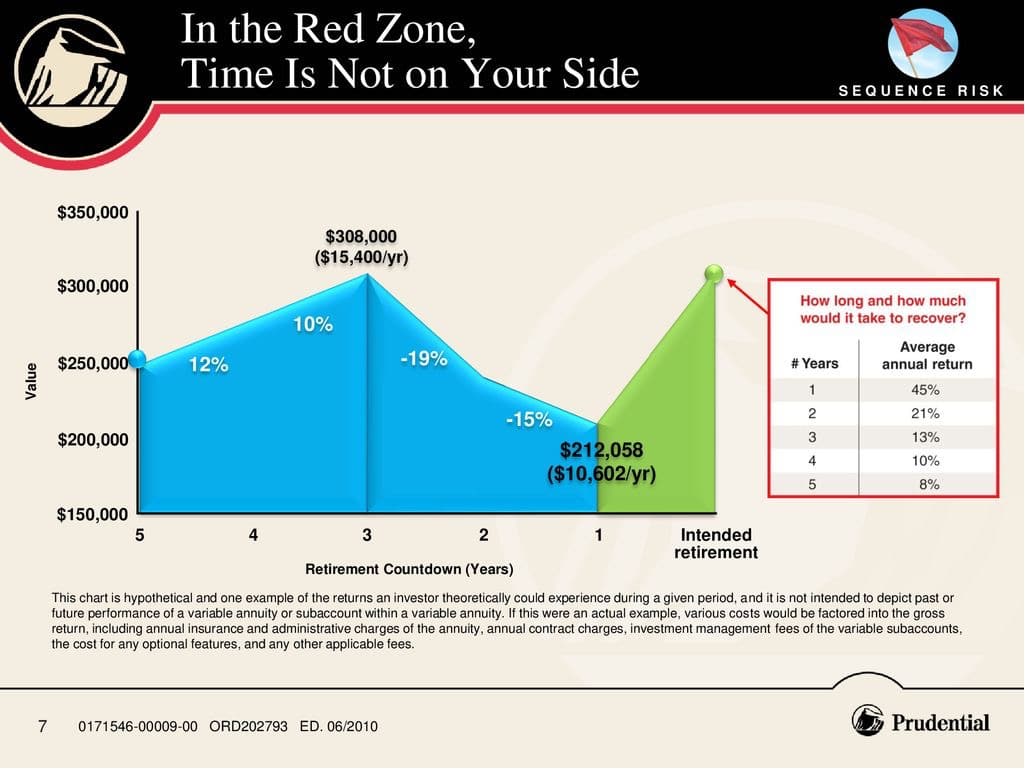

The Retirement Red Zone® was developed by Prudential. It is the 5 years before and the 5 years after retirement, and it is the most critical time of your investment life. It requires a solid investment strategy to help ensure your assets will sustain your retirement goals.

Long-term investing is one thing. Pre and postretirement investing is another. Why? Simply put, the stakes are higher. You can’t afford the short-term losses that a younger investor can, because you may not have time to recover from them. In other words, time is generally not on your side. That’s why the 5-year period before and the 5-year period following retirement may represent the most critical time of your investing life.

That said, when you enter the Retirement Red Zone®, it’s important to take extra care with risk mitigation. We use various products and strategies (active management, annuities, hedge, alternatives, etc.) with our clients to make every effort to both grow and protect their assets so they will last a lifetime. Our focus, especially during this window, is downside protection as we believe it’s better to minimize downside losses than maximize upside gains during this timeframe, and we help our clients plan accordingly.

We believe that the non-financial aspects of retirement are just as important, if not more, than the financial aspects. You heard me right! A common guideline for the Retirement Mindset is to “retire to something, not from something”. This is a good start, but we prefer to take it a step further to “Retire With Something”. You may be thinking, when I retire, I am going to have more energy, eat better, exercise, visit with friends, contribute to society, etc. Unfortunately, the picture in your mind may not match up to reality.

Retirement doesn’t make you happier, healthier, or more connected. It fosters the opportunity to be those things but waiting until you get there to make those changes will likely be frustrating (kind of like New Year’s Resolutions in April). “Retire With Something” serves as a much stronger message to encourage our clients to start living the life they want now instead of hoping they can create it later. We are creatures of habit, and as Stephen Covey said, “First we make our habits and then our habits make us.” We believe that the best way to thrive in retirement is to flourish in life before retirement, and we help our clients plan accordingly.

As you can see, at Virtus Wealth Management, we believe Retirement Planning is vital to securing your financial future prior to, during, and beyond retirement. We are here to help – Our goal is to help you reach yours.