I am sharing with you some of the information the Life Insurance Marketing and Research...

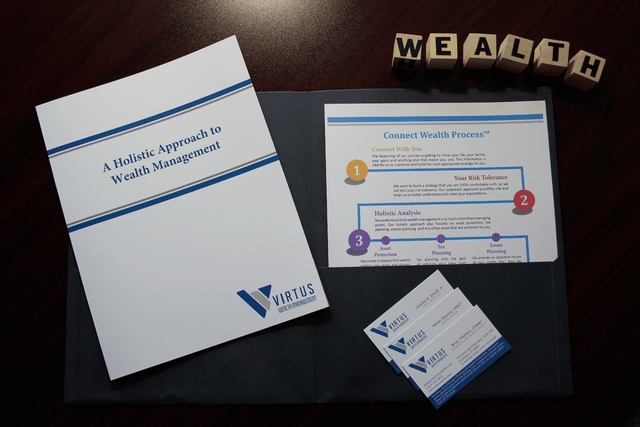

There are few things we enjoy more at Virtus Wealth Management than helping goal-oriented people pursue their goals. Our motto is “Our goal is to transform your long-term dreams into realities”. That, in a nutshell, is really what we are here to do.

Quite often, our newer clients don’t exactly know their long-term goals, especially if they are in the first or early second quarter of their life. Understandable. Thinking 20 to 40 years out can be a daunting task. We are here to help. We are here to help you establish goals, develop a plan to pursue those goals, monitor progress towards those goals, and possibly (even probably) adjust those goals as your life evolves and takes its course.

You may be wondering how, what’s involved, and do I really want to take this journey? Well, if you want to get on your way to financial freedom (an admirable goal by all), we’d highly advise you to set some goals. In general, people don’t end up financially free by accident. They are intentional about it. They have goals, develop a plan to pursue them, and execute. It’s that simple.

Again, easier said than done. We use a process to help our clients that works with ranges. We talk in today’s dollars to keep the frame of reference current. We explain that these are not absolutes. They are just to get the thought process going. Dream a little. What do you want out of life? What are the most important things in your life? What are your life destinations?

First, we discuss spending. We ask you how much would you like to “ideally” be able spend per month or year in today’s dollars. Then, we ask what the “acceptable” version of that would be. This gives us a spending range. If you have no idea, then we have another problem. You may not know how much you spend right now which would then be homework assignment number one. Once you know your current spending, you can judge if you are happy with that, would like to have more available, or are okay with having less.

Next, we discuss retirement age and, again, we work in ranges. “Ideally” when would you like to retire? What’s an “acceptable retirement” age? Do you want to semi-retire, like a second, less stressful career or to work part-time? At what age would you like to do that?

Next, we discuss legacy thoughts. Legacy thoughts revolve around what you want to leave behind when you are gone. Some of our clients want to spend everything before they go. Some of our clients want to leave a substantial amount to their heirs. Some of our clients are in the middle, and some of our clients don’t care — whatever is left is left. Again, if you have a legacy goal, we discuss it in ranges (“ideal vs. acceptable”) and in today’s dollars to keep it real.

Finally, we discuss additional items like education, travel, housing, equity planning, etc. These goals are ancillary to the big three listed above. The big three, to a large extent, drive the plan, but these additional items are important to consider and have more of a timeframe/time bound part to them. How much do you want to have available for education and when? Do you want a travel budget on top of your spending now and/or in retirement? Do you want to upgrade/downgrade your housing in the near- or long-term future? These can also have ranges associated with them like “ideally I would like to pay for 100% of my children’s college education, but 50% is acceptable”. Is there an equity planning event anticipated in your future like selling a business, an inheritance, or a trust distribution? Do you have goals associated with those?

It’s important to understand that we have a lot of experience with goal setting. Just like Farmers Insurance, “We know a thing or two because we’ve seen a thing or two”. We can use our experience to help you formulate your goals and guide you in pursuing them.

Once you know where you want to go, we are ready to develop a plan, right? It’s like a GPS. Imagine getting in your car to go on a trip and flipping on your GPS. What’s the first thing that it needs to know? Is it your destination, your starting point, or both? The starting point is just as important as the destination, isn’t it? If you are in a parking garage and your GPS does not have a connection to know where you’re starting, it just spins and spins and spins. You can’t even put in the destination.

The starting point matters, and the starting point for a financial plan is a Financial Inventory.

Of those three, which is the hardest to determine? Spending! Budgets are difficult to create and monitor because that miscellaneous category consistently gets out of control. This is when, if you track your money for a brief period of time, you will start to see where it’s really going. This is how you can find the ways that you are spending money that may not be giving you that much pleasure and is getting in the way of you investing more. This is the beauty of tracking your spending for a brief period of time. It will allow you to identify areas of little value and reallocate to areas of greater value.

Now that we have our starting point and our destination, developing the plan is easy. It’s again, just like the GPS giving you the route. The plan will show you the easiest way to get from where you are now to where you want to be. Viola!

Read more about our Connect Wealth Process™ to developing your financial plan here.

Now, we all know that sometimes (a lot of times), when driving, you will run into an accident or construction along the current route. What does the GPS do? It gives you options and re-routes you. In life, the same types of obstacles will present themselves like market movement, economic uncertainty, global conflicts, or a shift in your life. Maybe you turned right when the GPS said turn left? Maybe you did this several times. This is where we come in to offer advice and use the financial plan to adjust/re-calculate to still get you to that destination (your goals) in the easiest way possible. There’s no judgement. Does the GPS judge you? No! Neither do we. Life happens. Some things are in your control, and some things are not. We are here to support you and help you reach your destination no matter the circumstance.

At Virtus Wealth Management, we believe goal-based financial planning is vital to securing your financial future and getting around any curve balls that life may throw your way. We are here to help – “Our goal is to transform your long-term dreams into realities”