I am sharing with you some of the information the Life Insurance Marketing and Research...

With a recent college graduate and 2 more kids in college, I can understand why College Planning is intimidating, overwhelming, and, at times, seems like a lost cause. That said, I’m writing a 2 Part Series on College Planning to encourage you to think positive (understand your why), move forward, be proactive, and enjoy the journey. The first part is to illustrate the importance of college, projected cost, and the reality (or lack thereof) of financial aid. The second will be to explain the “Expected Family Contribution” and to illustrate how planning ahead (even if starting late) can help you get through it. There is power in college planning; it makes a difference.

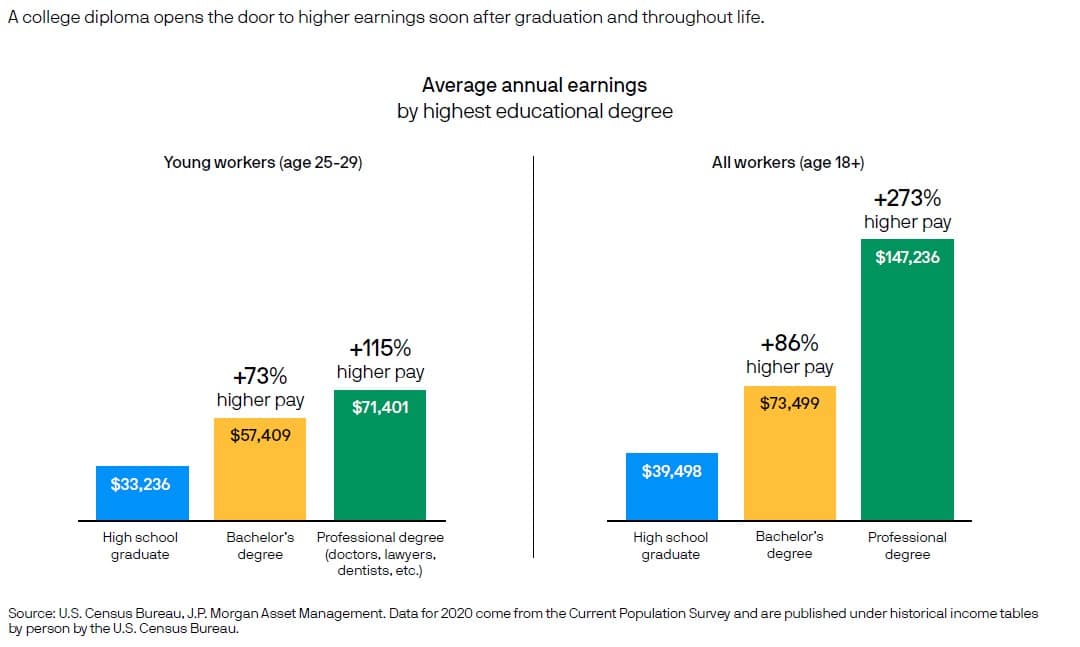

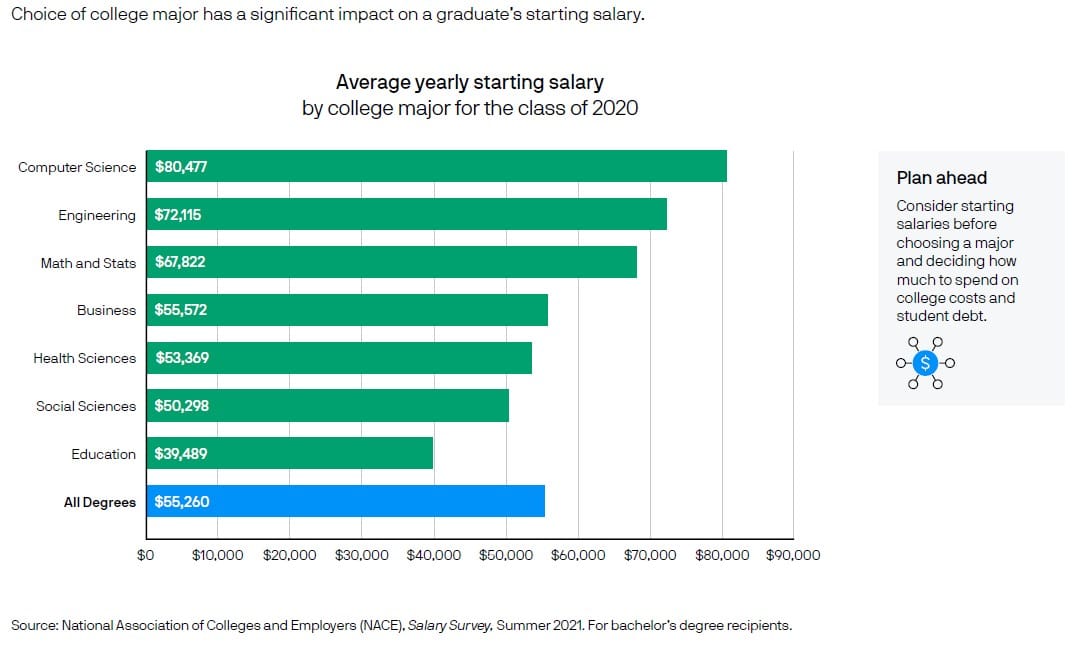

The following charts illustrate that higher education and choice of “major” within that education matters.

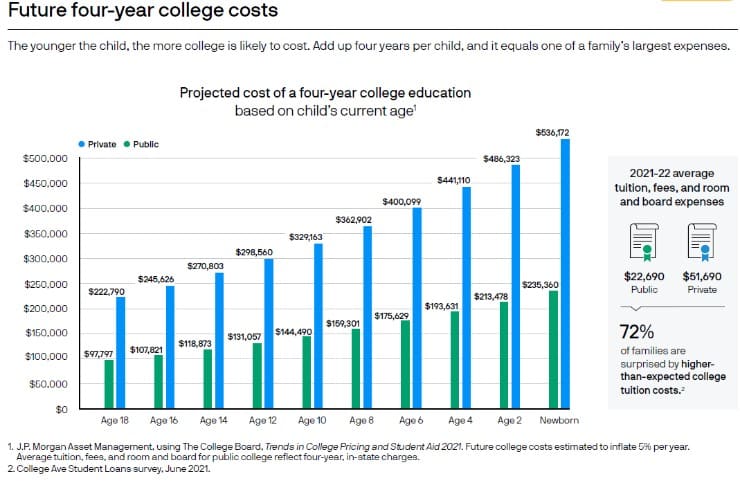

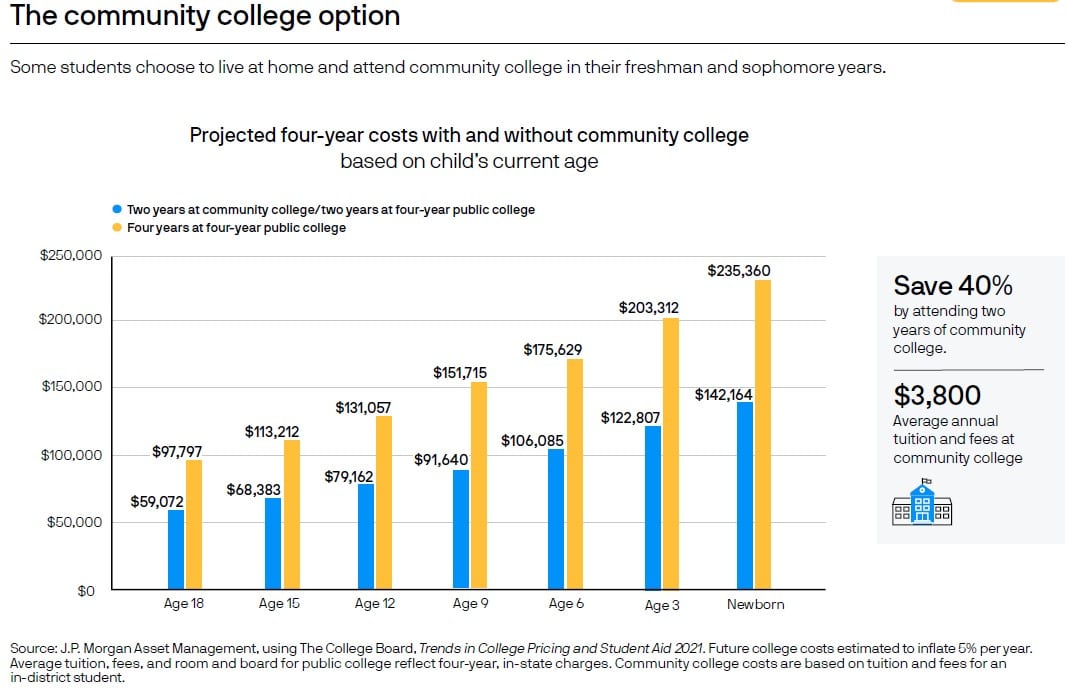

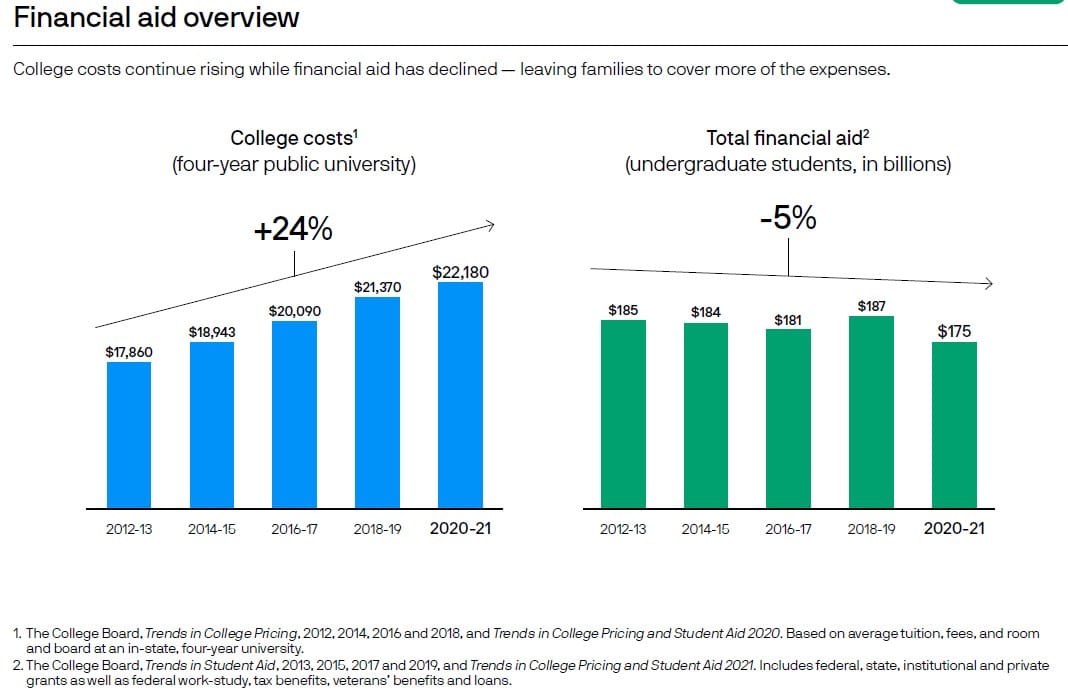

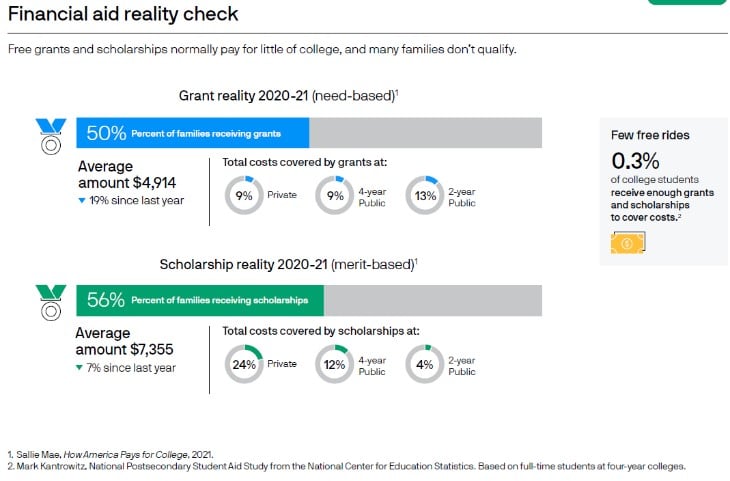

So, college matters — that makes sense. Now I am going to highlight some things that don’t exactly make sense – college costs, financial aid, and student debt. These are the things that make college planning intimidating, and how addressing them head on is what makes college planning (and investing as part of that plan) so powerful and important.

Wow! That’s a lot of charts. I’m hoping they help you get the picture. Heh!!! College matters. Inflation is here. College tuition will be impacted near term and, even more, long term. College costs are trending higher. Financial Aid is trending lower. College planning is critical. Stay tuned for Part 2 to learn how Virtus Wealth Management can help you harness the power of college planning for yourselves.