I am sharing with you some of the information the Life Insurance Marketing and Research...

Well, here we are in 2022 and, sadly, COVID-19 rages on. So, what’s happening out there with college planning as it relates to COVID-19? I, myself, have a recent college graduate (yay!) and 2 more kids in college (boo!). I understand first-hand how planning for college can be an intimidating obstacle!

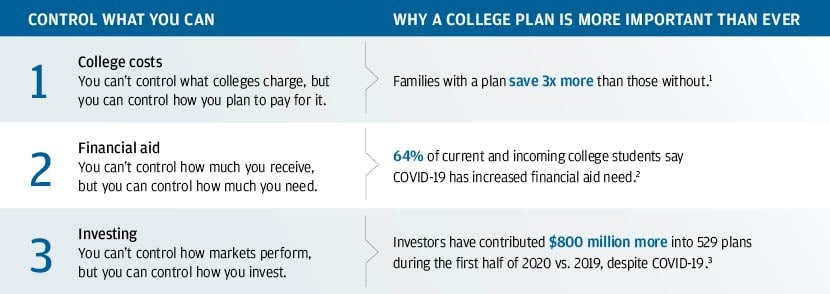

The key is PLANNING. You can’t control what happens with college, but you can control how you plan for it. So, what is the status of college and COVID-19?

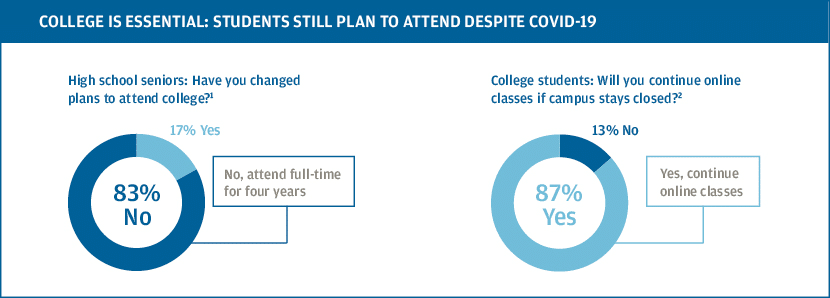

In general, you would inherently think that kids would be staying closer to home. That is, unless you have a high school senior or an existing college student. Research shows that most high school seniors and existing college students still plan to attend Four Year colleges even with COVID-19.

COVID-19 is definitely making it harder to estimate future costs. Will universities increase prices to offset losses from falling revenue from sports and possible reduced student enrollment (although chart above suggests otherwise)? Or will universities decrease prices to encourage enrollment despite health risks and to compete with online options? It could go either way, and only time will tell. There is no straight-forward answer here.

Financial aid is not a given. Total aid has been trending lower over the past decade and may fall even further in the wake of COVID-19. If financial aid declines, the need to invest only rises. Keep in mind that even before COVID-19, the average grant covered just 12% of the total bill at four-year public colleges — and nearly half of families earned too much to qualify.1

1 Sallie Mae, How America Pays for College, 2019.

Our advice is to control what you can, and you can control how much you invest and save for college. Savings alone will be tough with inflation well on its way, so investing is critical. It will, more than likely, take long-term investing to keep pace with rising costs and to achieve your college funding goals.

Again, with so many things out of our control, the key to college planning is to control what you can. Create a college saving and investment plan, be consistent, and follow it. You will get there before you know it.

If you have questions about college planning, we are available to help with various strategies to pursue your college funding goals whether you are years from college, college is starting soon, or college is here now. Control the controllable!!!

The opinions voiced are for general information only and are not intended to provide specific advice or recommendations for any individual.