We at Virtus Wealth Management take pride in offering multiple services through all stages of...

I’ll admit that I have a love, hate relationship with diversification. As a financial advisor, I think diversification is the only way to go. It’s important to mitigate risk, and as this cartoon so accurately illustrates, “as your financial advisor, I have to warn you that it’s risky to carry all of your eggs in one basket.” I love risk mitigation. Proper diversification aims to provide financial confidence in good markets while striving to put you in a position to help mitigate losses when the economy goes through hard times.

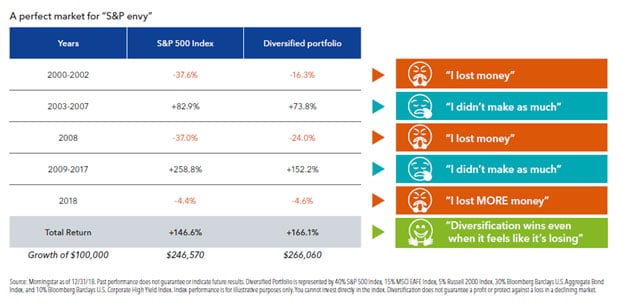

At the same time, I hate diversification because it can feel disappointing. When the market is up, your portfolio may not be up quite as much. When the market is down, your portfolio may not be down as much, but it is still down. It just feels like you’re not making as much on the upside, and it feels you are still losing on the downside. When looking at your portfolio year to year, it’s hard to see how using diversification to mitigate losses benefits you over a long period of time. That said, the timeframe is the key, so take heart! Investing is for the long term, and over the long term, diversification tends to win out even when it feels like it’s losing!

Here at Virtus, diversification is one of our investment strategies, but we also know that effective wealth management extends beyond financial planning and investing. Wealth Management is, by definition, a holistic approach to understanding and providing solutions to all of the aspects of a client’s finances. We believe that by building a solid and valuable partnership with our clients, we can coordinate and unify the decisions in their financial life, so that those decisions complement each other and aim to produce enhanced results. If you would like more information, please feel free to give us a call at (817)717-3812.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Past performance is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk and no guarantee of positive results.