I am sharing with you some of the information the Life Insurance Marketing and Research...

January 2022 ended up being a volatile month for the markets. The NASDAQ hit the official correction level (when a market drops 10% or more) while the S&P 500 just missed that mark dropping 9% and change. The markets then rebounded a bit at the end of the month, with the S&P finishing down 5.26%.

The main culprit, at least via the media, was the Federal Reserve’s (Fed) commitment to raising short-term interest rates. As usual, there is a lack of context from the media when they push the alarm buttons.

First, typically, and this case is no different, the Fed raises rates when the economy is too strong. When the economy is too strong it leads to there being more dollars chasing the same or fewer goods, making prices increase. This problem has been exacerbated by the supply chain issues. Now we have a strong economy, meaning people have more money, not chasing the same amount of goods but actually chasing less goods due to the supply chains problems.

This led to the scary December 2021 inflation rate increase of 7% over December 2020. A huge increase not seen in over 40 years. We saw a similar number in January’s report. We also haven’t had a pandemic like the one we are living through over that same 40 years. If we dig into the numbers, we see there is good and bad news. It isn’t as horrible as first glance. For example, the top 3 drivers of the 7% increase are oil and gas prices, used car prices, and lodging away from home (hotels, resorts, etc.). Per the Pew Research Center, approximately 1.5% of the 7% inflation increase was new and used car sales. This is not a long-term issue. There is no reason to concern ourself with some 1970s like inflation rate due to used car sales being inflated because of the chip shortage in new cars.

Same goes for lodging away from home. It shouldn’t surprise anyone that travel prices in December 2021 were higher than they were in December 2020, when travel demand was significantly lower. If you compare travel costs from December 2021 to December 2019, prior to travel being shut down due to Covid, the prices for airfare are on par according to the airfare tracking application Hopper. Demand for lodging would logically be higher in 2022. Using 2020 as your base case is very misleading.

I am not implying or stating there are no concerns. Oil prices and the price of food, specifically meats are alarming. Hence why the Fed is raising rates. I want to be very clear here, there are inflation concerns. The Fed first stated much of the inflation pressures were transitory (semiconductor chip shortage as an example). Now we are witnessing real inflation. What is important here is the 7% number is very misleading. It is more likely in the 4-5% range, which is too high but not as close to the headline rate of 7%.

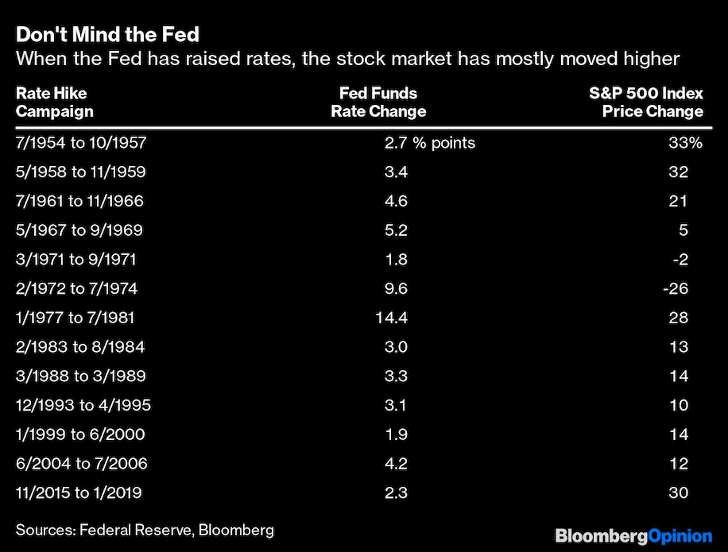

Regardless, the Fed is raising rates. There is a myth out there that stocks don’t perform well in rising rates. Check out the graph below which tells a different story.

Investors typically don’t like uncertainty. When the Fed is in the beginning phase of raising rates, there is uncertainty of how high and how quickly. Over time the Fed is able to spell out their plans better due to more information. It then becomes a question of expectations. If the Fed is expected to raise rates three times in a given year, the market will price that in. If they raise rates three times, those three rate hikes will have little or no impact on the market. If they change course and only raise rates twice or four times, the market will react because it wasn’t expected.

Bottom line, don’t fear rate hikes. They actually can be good. It is also important to understand the starting point is important. A 2% interest rate increase when you start at 0% is much different than a 2% increase when the starting rate is 6%. Two to three percent rates can still be business friendly. We have been sitting at historically low rates for years. There is room for rates to move up and the economy still grow.

One of the biggest lessons in investing is ignore the white noise and focus on earnings growth. Can earnings still grow if the Fed raises short-term rates 3 or 4 times (2% total)? Most definitely. If the inflation rate remains 7% or higher for a significant period, earnings will very likely be negatively impacted.

If you would like more information or to discuss this further, please feel free to call me at 817-717-3812.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. Economic forecasts set forth may not develop as predicted.