I am sharing with you some of the information the Life Insurance Marketing and Research...

A fun song from the 1990s from the late and great Prince. Part of the lyrics from that song included, “well, life is just a party, and parties aren’t meant to last.” Just think back to really how amazing that time was.

There was also a bubble in the technology stocks that lasted from 1996 until it popped in March of 2000.

Speaking of stock market bubbles, think about when you were young, had a piece of gum in your mouth and then started to blow a bubble. How you tried to see how big you could get the bubble before it popped. That same phenomenon happens in investing, it is just money not gum. These bubbles grow and grow and you never know when it will pop. We know two things going in, it will eventually pop and, if you aren’t careful, if pops all over your face.

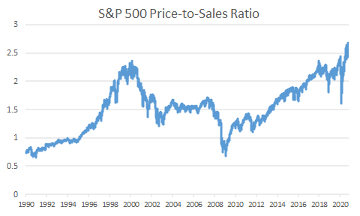

Many people think the “market” is over-valued and that we might be in a technology stock bubble right now. We may very well be. However, there is good and important news in this article so please don’t stop reading because you might think this is about the market dropping a lot. Back to the bubble. There are so many similarities between the two periods, including people rationalizing why valuations don’t matter, experts opining it is different this time (recall the saying from Sir Templeton, “the four worst words in investing is it is different this time”), and the younger population driving the buying spree in stocks. The NASDAQ is currently at price to sales ratios (P/S) only seen in the late 1990s if you go back to 1969 (source Ned Research). The P/S ratio is the multiple of revenues a stock or market has currently compared to its price. The higher the number, the more expensive it is to buy. Expensive in of itself isn’t bad. Some expensive items are worth the price. However, when an entire asset class gets expensive, it should be a bit concerning.

Here is a simple chart that clearly points to a valuation issue today.

Source: Standard and Poor’s; Bloomberg

The important point here is the market is not one big market but a subset of many smaller markets. There is large cap value, large cap growth, mid cap, small cap, international, etc. We have written articles warning people of just looking at the S&P 500 as a benchmark. The index does not represent small and mid-sized companies, international, real estate, and other markets.

The reason is even in the dot.com crash from 2000 through 2001, many market subsets actually performed well. For example, mid cap and small cap stock indexes were positive those 2 years. As was real estate. Just because one subset of the market is over-valued does not mean the entire stock market is likewise over-valued.

Our strategy is “down and out.” This means instead of only large cap stocks, which is represented mostly by the S&P 500, we are over-weighting in smaller companies in the mid to smaller market cap size and international where appropriate.

The main reasons I am still positive on equities is due to the current low interest rate environment, which must be considered when looking at valuations, and the spend rates of governments across the globe. I am just much more positive on certain sectors or market caps over other classes. Which leads to another important point.

One last important note, back to the bubble gum metaphor, you just never knew how large the bubble was going to get. Sometimes you would produce this huge bubble that impressed all those around you. Other times it popped early. Stock market bubbles have their own shelf life and are impossible to predict when they are going to pop. This could go on for years considering interest rates being so low.

Finally, be careful trying to go to all cash or bonds. With current inflation signals and interest rates, you may be signing up for a loss of long-term buying power.

If you would like to discuss this further feel free to give me a call at 817-717-3812, I’d be happy to go into more detail with you.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results.

All indices are unmanaged and may not be invested into directly.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.