6 Facts Regarding Oktoberfest and 5 Facts Regarding the Stock Market in October Many of us love...

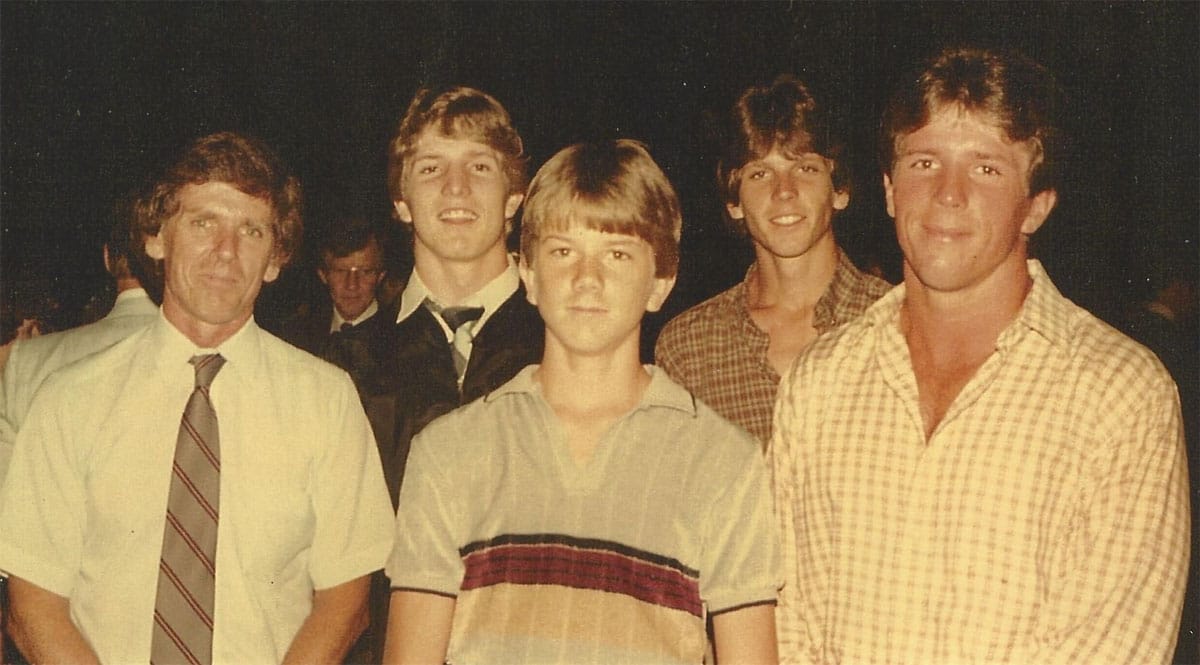

My dad passed away on July 27, 2003. It seems like just yesterday in some regards but so long ago in others. He, being a good father of a Wealth Manager, had a traditional will in place as well as other important documents. However, now it seems so unimportant. I don’t mean that one shouldn’t have a will, but that it is a document only needed for a short period of time to handle the material things. A will usually doesn’t continue a legacy. It is a statement of what should happen at a certain date, and rarely ever reviewed again, not so with an Ethical Will.

Years later, wouldn’t it be great to hear from your loved one again or to learn about or revive memories of what made them who they were?

So what is an Ethical Will? Ethical Wills are a means to transfer intangible assets. Although they are not legally binding, they can be important just the same. Ethical Wills can be anything you want them to be. They can give directions on how you want the assets to be treated after your death. For example, if you have an IRA you want your adult children to stretch instead of cashing out; those instructions can be in the Ethical Will. More importantly, it can also be your lasting legacy in which you share your principles, values, and fundamental beliefs. The purpose is to pass on a long-lasting message for your loved ones.

I know for many it is hard to get started creating something this important. Your Ethical Will could be something your great, great grandchildren read and learn from. There is no set form. You can express these via a letter, video, audio or a collection of each. How you decide to prepare your Ethical Will is as personal as the information contained within. Click here for a list of questions I found in an article written by John Kador. This might help you take the first step in this long-lasting legacy experience.

I can tell you I will never review my dad’s will again, but I would re-read his Ethical Will over and over again if he had created one. We are here to help you build long lasting legacies that surpass wealth accumulation. Please call if we can help you with this or any other wealth management questions you may have.

List of Questions to Get Started

This information is not intended to be a substitute for individualized legal advice. Please consult your legal advisor regarding your specific situation.