I am sharing with you some of the information the Life Insurance Marketing and Research...

“Inflation is when you pay $15 for the $10 haircut you used to get for $5 when you had hair.” Sam Ewing.

Within the investment community there is a hot debate regarding if the recent alarming increase in inflation is transitory or here to stay. I will attempt to address both of those possibilities today. First, we must set the table.

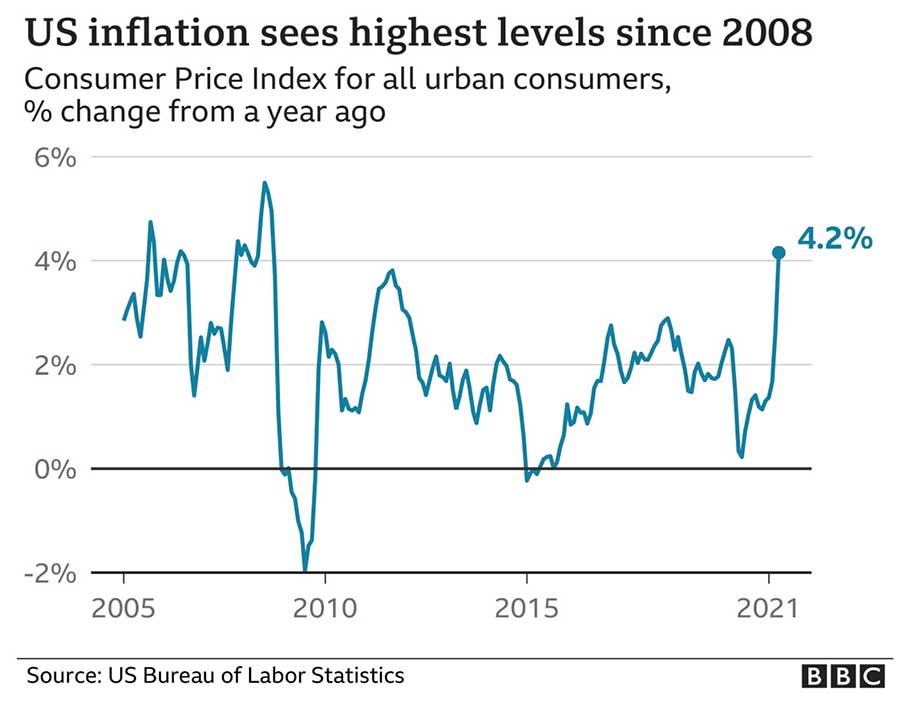

In both April and May, the inflation reports came in worse than expected. Once can be an anomaly but twice is concerning. As we can see with the following chart, the increase has been substantial and quick but not currently at troubling levels.

The question is if this is just a short-term blip or an omen for longer-term issues. The current Fed chairman, Jerome Powell, stated in March that he believes the increase is transitory. There were many reasons to expect a short-term increase like this. There was significant pent-up demand, especially in travel, coming into 2021 just waiting for travel to open up. More importantly, this was one of the most unusual recessions in recent history. When Covid 19 hit in the first quarter of last year, many expected a prolonged recession. The market’s drop from peak to trough of 35% reflected that concern. When the expectation is for a prolonged recession, companies pull back on production. However, the recession was much shorter than expected. This created a short-term supply versus demand issue. Those tend to work themselves out quicker versus slower.

Then we have the stimulus checks many Americans received. Due to the travel restrictions and many entertainment industries being significantly curtailed, that money was directed more towards goods. All of this created a situation where demand greatly outweighed goods. This includes housing, in which the pull back in production of lumber and other materials was followed by a material increase in demand for real estate. Lower interest rates also played a part in the real estate boom (bubble?).

Those that believe this is transitory, believe that the supply versus demand issues today will be worked out sooner rather than later. The semiconductor chip shortage, which is causing the imbalance in automobiles and other electronics, will likely take at least the rest of the year to work out. Other imbalances are expected to be fixed sooner according to those that believe this is transitory.

The principal concept behind the worry that this will be longer-lasting is the economics of the money supply. If the government is printing money, inflation is expected to increase, all else equal. Many point to the fact that the federal deficit increased 29% in 2020, more than any other year since 1943. In a nutshell, the more money in the economy, the more money chasing the same goods.

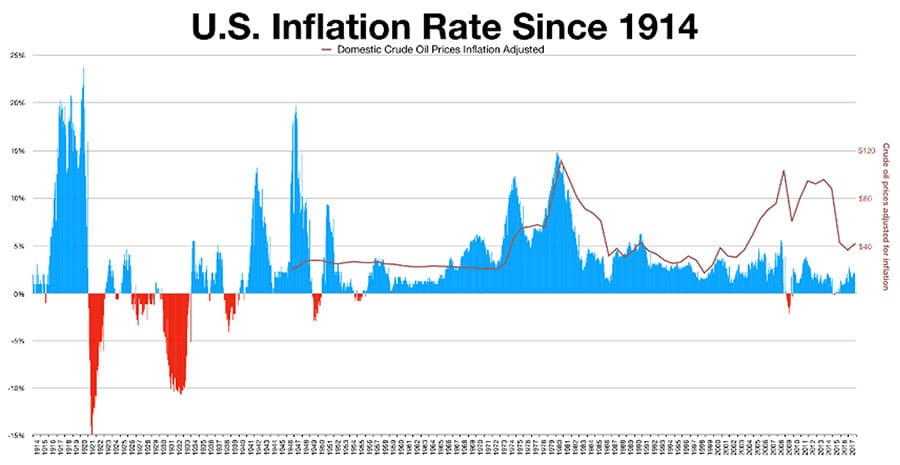

Inflation after the spending spree by the government in 1943 to fund the war, was met with little inflation the following two years but did jump in in 1946 and 1947, as you can see in the chart below.

As you can see though, it was a short-term increase followed by a 15-year period from 1950 to 1965 of reasonable inflation.

It is hard to actually compare the periods because there were some major differences versus today. One, the government implemented price controls for multiple years in the mid-40s. They were lifted in 1947. How much of that short-term inflation was due to pent up price increases needed by industries?

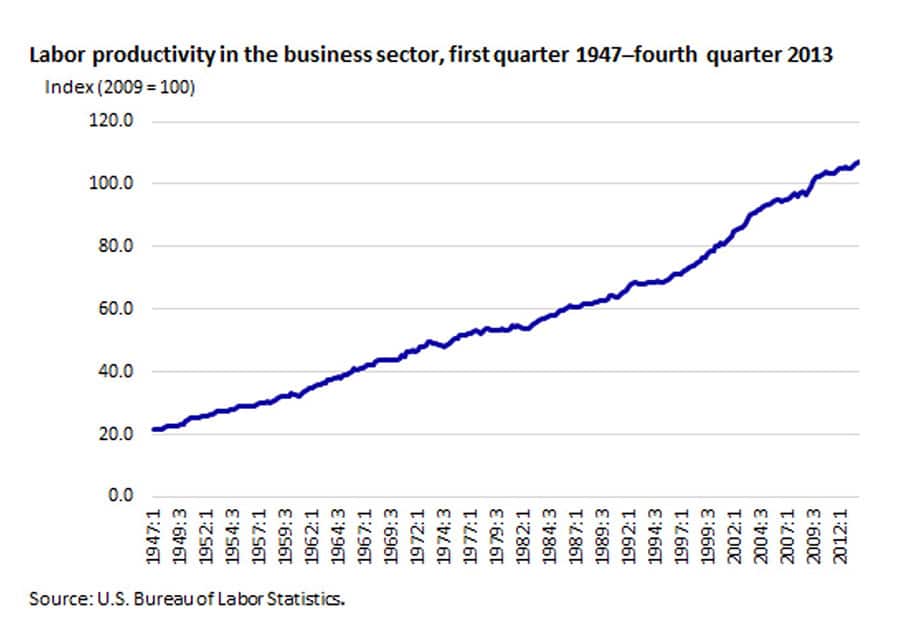

The other, and one that cannot be ignored, is the best way to curtail inflation is by productivity increases. We are still in a technology revolution that continues to increase production and lower costs. I believe Covid 19 sped up many of these production advancements. Zoom meetings decrease travel costs for companies as well as the movement to working from home saves money on rent. The quick adoption of electric cars helps curtail gas prices. That isn’t going to be a savings just for consumers but businesses as well. Cloud networking, where files are now saved via the internet and not in individual data centers or file cabinets, also saves labor costs. Artificial intelligence should continue to increase production. See the chart below for the production efficiencies seen since the 1940s.

Inflation numbers are definitely a red flag and concerning but I believe it is too early to make wholesale changes to portfolios. We have made some changes to offset the impact of possible inflationary pressures. We need to see how the next few quarters go to determine the impact of the supply versus demand issues. Will the removal of the extra unemployment benefits slow down wage increases due to an increase in the number of people seeking jobs? Will the current material imbalances see marked improvement when companies catch up with demand?

The two areas I am most concerned about and watching closely are (1) Wage increases. It is hard to have inflation without wage inflation. Spending typically leads to inflation. (2) How long does the Fed keep short-term interest rates down. This is my biggest concern. The Fed is in a delicate position. Interest rates that outweigh economic growth will create a significant increase in the debt servicing of our deficit. Keep them too low for too long will spur the economy too much, creating inflationary pressure.

There is a big moral to this story though. If you are really concerned about inflation, cash is not where you want to be long-term. You are just losing purchasing power. It is a double whammy. We believe it is important to be in areas that perform better during inflationary periods.

If you have any questions or would like to discuss this further, I am just a phone call away (817) 717-3812.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.