I am sharing with you some of the information the Life Insurance Marketing and Research...

A year like 2013 can spoil any investor, high returns with low volatility. The largest “correction” in 2013 represented an approximate 6% decline. If you look at it from a monthly perspective the largest decline was a measly 3% drop in July. If only the market was like this every year…

However, that is not the norm. Volatility should be expected in the stock market. Corrections and “basing” (when markets trade sideways for a length of period) are healthy for the market and allows one to clean up their portfolio by selling underperformers and buying better stocks at cheaper prices.

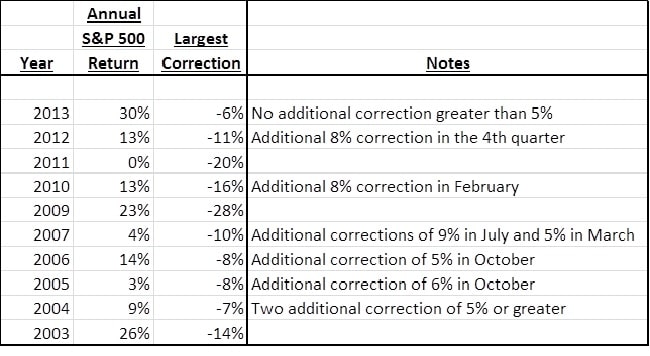

Let’s look back at the past ten positive years (excluding the 2008 crash) in the market.

Source: Yahoo Finance

As you can see, the only other years in which we had corrections less than 10% were in years with muted returns (2004 and 2005) and/or they had at least one additional 5% or greater correction in the year. Even if one looks at the great technology market in 1999, in which the index for Technology stocks (NASDAQ) was up approximately 85%, there were corrections of -13%, -10%, -9% and a couple in the 5-8% range during the year.

We must filter out the white noise and focus on the Federal Reserve Policy, earnings, and GDP growth. This correction was long overdue but, as of Tuesday, February 4th, it did not breach an important technical support. As I write this, the market is up a little today. That is because the market does not move in a straight line either up or down. I don’t believe the correction is over yet as we could definitely see 1,700 for the S&P 500 (currently at 1,750).

However, interest rates are still low, The Federal Reserve is committed to keeping them low through 2015 and I project GDP to be in the 2.5 to 3.0% this year. Bottom line, the market got a little ahead of itself and needed to correct, but the environment is still positive for companies to increase earnings.

Market activity like we have seen the first of the year, understandably, may be concerning to investors. However, we believe one of our objectives is to help you keep your eye on the bigger picture; and again, we appreciate the opportunity to serve you.