I am sharing with you some of the information the Life Insurance Marketing and Research...

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.” Charles Dickens

It is as if Dickens wrote that for the first half of 2020. What a year we have had so far. Kids today have lived a decade if not longer in just 6 months. We have a virus unlike anything we have seen since 1918. We have witnessed lockdowns unlike ever before. We have had major protests across the land.

And then we have the markets doing their best Jekyll and Hyde impersonations. In March, the S&P 500 was 35% off its high. By June, which is basically 2 months, we were off the highs by approximately 5%. An amazing turnaround.

The question is what drove the rebound? Was it really due to fundamentals? Or computerized program trading? According to an Aite group study in 2017, 70% of all stock trading is due to algorithmic trading. Program trading is based less on fundamentals and more on price movement. Meaning buying begets more buying but selling begets more selling. Wherever the momentum goes, the programs trade it. Maybe that is why we continue to see such quick swings in the markets? The problem with momentum trading like that is momentum cuts both ways. There is both upside and downside volatility.

Program trading is a short-term impact though. Long-term the market still trades on earnings growth. I would recommend people not get too excited about this rebound unless you are a trader. The reason caution is necessary is twofold. First, we have projected GDP (Gross Domestic Product) growth versus market action.

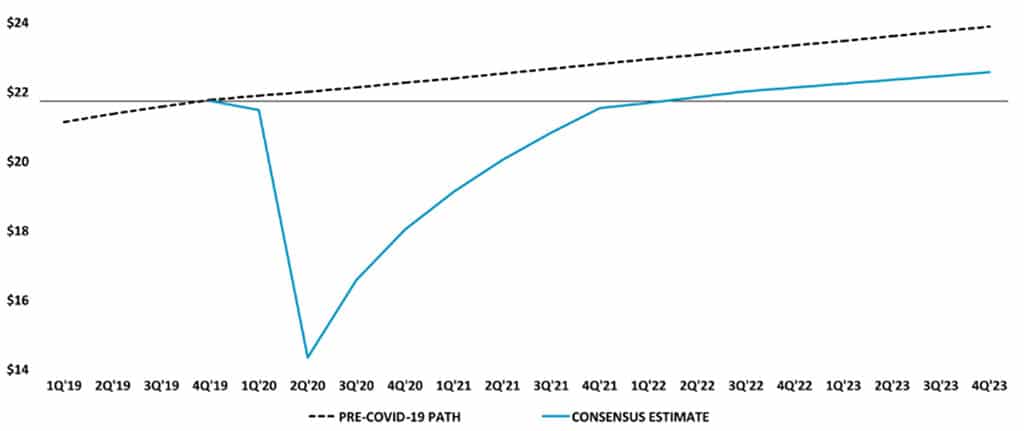

In the chart below, we have the projected U.S. GDP growth from the top 10 major banks. As you can see, GDP isn’t supposed to hit pre Covid-19 peak levels until sometime in the fourth quarter of 2021 or first quarter of 2022. However, the S&P 500 is only single digits off its high at this writing? If the projections are correct, the market needs to trade flat for over a year. That rarely happens. It is actually worse than that because the peak prices in February of 2020 assumed GDP growth going forward. If that little teaser peaks your interest give me a call and I can explain further, but to keep this article from getting too long and complicated I will continue on to reason number two.

Figure 1: Consensus Estimates for US Real GDP Growth

(US$ in trillions)

Source: Blackstone “Waking from the Slumber:” Bloomberg, as of 5/21/20. Represents the average of the major banks

The second reason caution is necessary is due to the current spike in virus cases. We are dealing with a novel virus. The market has priced in perfection when it comes to the virus. No more lockdowns, no more healthcare scares, and no significant rises in total deaths. That very well may be the case, but as we see here in Texas, things aren’t as rosy as the market appears to believe.

There is a third reason but it really can’t be quantified any longer. Corporate bond spreads, which just means the difference between corporate bond yields and treasury yields, were at alarming rates in March and even early June. The higher the average spread, the more risk the bond market is pricing into the economy. I talked about this in our webinar COVID-19 Where Do We Go from Here?, as it was a concern of mine. However, the Federal Reserve started buying corporate bonds in mid-June due to The Cares Act. Buying helps lower the yield. But this is manipulating the true bond spreads since the Fed isn’t buying because they think the economy is strong, they are buying to boost the bond market up. No one knows what the true corporate spread is at this point.

To summarize, I believe the market has gotten ahead of itself. Maybe due to program trading, maybe due to the belief the worst is behind us regarding the virus. However, just like we shouldn’t live in fear, we shouldn’t invest in fear either. That doesn’t mean we shouldn’t be cautious in both. Your risk tolerance obviously plays a huge part in this. If you are young, typically more risk can be taken by an investor. However, if you are within 2 to 3 years of retiring or 2 to 3 years after retiring, caution should rule due to the sequence of return risk we have written about many times. If you want more information about this, please visit our website Virtuswealth.com for the articles.

The most important thing is to know how much risk you are really taking. We have two different software tools that can help you understand the risk you are taking if you aren’t sure. Visit our Rate You Risk page on our website or contact our office for assistance with these software tools.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The S&P 500 is unmanaged and may not be invested into directly.

The market value of corporate bonds will fluctuate, and if the bond is sold prior to maturity, the investor’s yield may differ from the advertised yield. Bond yields are subject to change. Certain call or special redemption features may exist which could impact yield.

Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value.Scammers are taking advantage of the fears surrounding the Coronavirus.