I am sharing with you some of the information the Life Insurance Marketing and Research...

My last Myth Buster article discussed the myths of the millennial generation. Today I would like to discuss the myths regarding baby boomers. As many of you know, my mid 20’s daughter works in our firm as Director of Communications. She is a proud millennial. When I wrote the article on the myths of the millennial generation, she was quickly in my office saying “told you so.” Now it is time for us baby boomers to turn the table and show the millennials some myths many have about our generation.

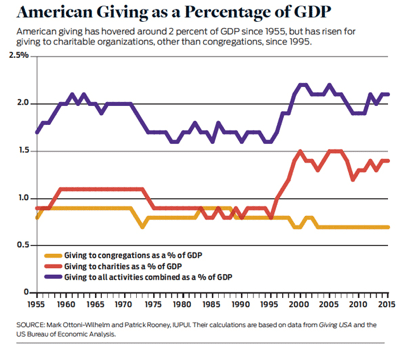

Baby Boomers are “all about me.” Baby boomers were labeled the “me generation” years ago. However, research shows that charitable contributions have increased as a percent of GDP over the years. As the following chart shows, even before the first baby boomers hit 65 in 2011, charitable giving was increasing:

Baby Boomers are Technology Challenged. Time to put this to rest. True, compared to the millennials, baby boomers are likely less technological advanced. That doesn’t make them challenged though. A 2017 study by AARP, title “Getting Connected, Baby Boomers Embrace Technology” found that 7 out of 10 people over 50 own a smart phone. Some millennial reading this is laughing right now thinking owning and using are two different things. This is changing fast. In a survey by Provision Living, they found the average millennial spends 5.7 hours a day on their smart phone while baby boomers are at 5 hours. The top 3 areas of time spent were Facebook, Instagram and texting for millennials (169 minutes in total) and Facebook, Instagram, and mail for baby boomers (147 minutes). So actually, usage is not much different between the groups.

Baby Boomers are Downsizing. It is hard to find stats from generations before baby boomers on downsizing. What we know is the trend of downsizing continues to slow. A recent 2019 survey by Chase Bank, 52% of boomers plan to never move from their current house, up from 47% in a study done in 2017 by USA Today.* One key reason for this could be baby boomers (remember the “all about me” stereotype) are taking care of both parents and adult children. A 2018 study published by The National Association of Home Buyers (NAHB) found that 26% of adult children live with their parents in 2016 versus 15% in 2000. From the Wall Street Journal Article on Nov 16, 2018 title ’I Was Hoping To Be Retired:’ The Cost of Supporting Parents and Children, the number of adults supporting both an adult child and a parent has doubled over the last decade.

Baby Boomers are the richest generation. A very misleading stat because that is more due to the sheer size of the generation. On a per capita basis, baby boomers as a generation are not great savers. A Stanford Center of Longevity study showed that baby boomers on average had 30% less wealth than the silent generation, partially due to having 40% less home equity. Furthermore, some research, like the Insured Retirement Institute (IRI), found that the baby boomer generation is in a retirement savings crisis. The IRI research showed that 45% of baby boomers have no savings. Of the 55% that have saved, only 28% of them have saved over $100,000.

I increasingly see new studies or findings on each generation in the news or on social media. I want to remind you that these are simply generalizations and should not affect your financial planning. It is important that you have an open dialogue with your financial advisor so your plan reflects your unique wants and needs: whether or not you plan to donate to charity, support children and parents, stay up-to-date with all the latest technology, or downsize your home.

If there is anything I can do to help you feel more confident in your financial plan, please give me a call at (817) 717-3812.

* More baby boomers stay in their homes as they reach retirement, skipping downsizing, USA Today May 2019

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual