I am sharing with you some of the information the Life Insurance Marketing and Research...

White Noise definition per Webster Dictionary:

a: a constant background noise, especially: one that drowns out other sounds.

b: meaningless or distracting commotion, hubbub, or chatter.

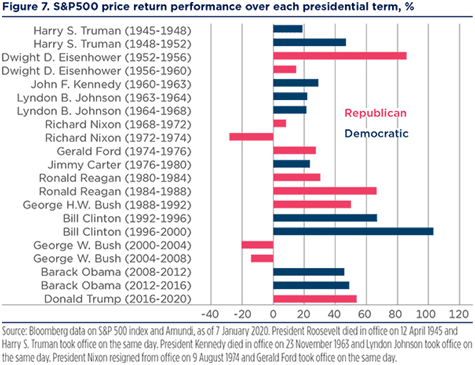

The impact of presidential elections on the markets falls under the second meaning. Let’s get it out of the way up front, there is insignificant differences between the stock market returns under a republican president versus a democratic president. The average return with a republican president is 8.8% per year versus 8.6% with a democratic president, this includes all past presidents. (1)

If you look since World War II, the markets have actually performed better with a democratic president in office.The most favorable returns at 10.9% per year have been with a democratic president with a divided congress while the least favorable result at 8.2% have been with a democratic sweep. There are many disagreements within our industry as to the reliability of these returns, specifically how much of it was impacted by good or bad luck. If it was luck at all. Or who is to blame. For example, who is to blame for the 2008 great recession? The residing president or past presidents? The answer most likely depends on one’s political leaning. I can make a very valid argument that the problem started as far back as a decade before when acting Federal Reserve Chair Alan Greenspan decided to flood the economy with liquidity due to worries about Y2K, which helped exaggerate the dot.com bubble, which turned into the real estate bubble that led to the 2008 crash. Others might put more blame on the regulation free era of G.W. Bush.

Worrying about the impacts on the markets if a certain party wins keeps us from focusing on what is important; the market has never dropped longer-term just because a party has taken office. It doesn’t work that way. Since WW II, every democratic president has had a positive S&P 500 return while in office. Only two presidents had negative returns; Richard Nixon and G.W. Bush (see above). The latter being a great example of how bad luck was a large part of the blame. He just had the misfortune of taking office right when a bubble, one he didn’t create, popped.

I want to be clear: I believe the markets are more driven by business cycles rather than who sits in the Oval Office. My focus will be on the industries that will benefit based on party leadership. A prime example is oil and gas versus alternative energy, infrastructure versus high tech, international (specifically China) versus domestic, and health insurers vs. drug manufacturers. Not all industries will be impacted equally when Biden or Trump wins.

There may be short-term volatility at the end of this year if Biden wins due to worries regarding the capital gain tax rate increasing from 20% today to his proposed 39% for those, and this part is important, with income over $1,000,000. Ironically, this will cause many people with less than $1,000,000 to sell even though their capital gain rate isn’t expected to increase, creating an unnecessary tax hit this year. Our investment focus though should be longer than one month.

The media wields a lot of power over the US political process. But in this time of social media news and fake news, it’s important not to get distracted by white noise in the media. When looking at your portfolio, we encourage you to trust the process and your plan. Don’t let news of the presidential election and the outcomes impact on the market affect your emotions or compromise your future. Focus on the long-term and how you are progressing toward your goals.

If you are not currently confident in your financial plan and long-term goals, we offer a Professional Service Review service for a one-time, competitive fee. Our advisors can help by looking at all the aspects of your financial life and help ensure they are working efficiently for you. This service is offered to those who are not current clients of Virtus Wealth Management. We conduct regular review meetings with our clients to ensure we stay on track as your life, assets and goals change. If you would like to schedule a meeting with one of our advisors, please call us today at (817) 717-3812.

(1) Presidential Elections and Stock Returns by Jurrien Timmer, Direction of Global Macro for Fidelity Management

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results.

The S&P 500 is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The S&P 500 index is unmanaged and may not be invested into directly. All investing involves risk including loss of principal.