I am sharing with you some of the information the Life Insurance Marketing and Research...

It’s our belief that all of us are made to have meaning and derive purpose from something. Aside from relationships, a large part of that meaning for many people is derived from their career. The idea of waking up and not having to work can sound great when you are still in the day-to-day grind, but that elated feeling can wear off quickly. We find that our most content clients are committed to being and staying active in one way or another.

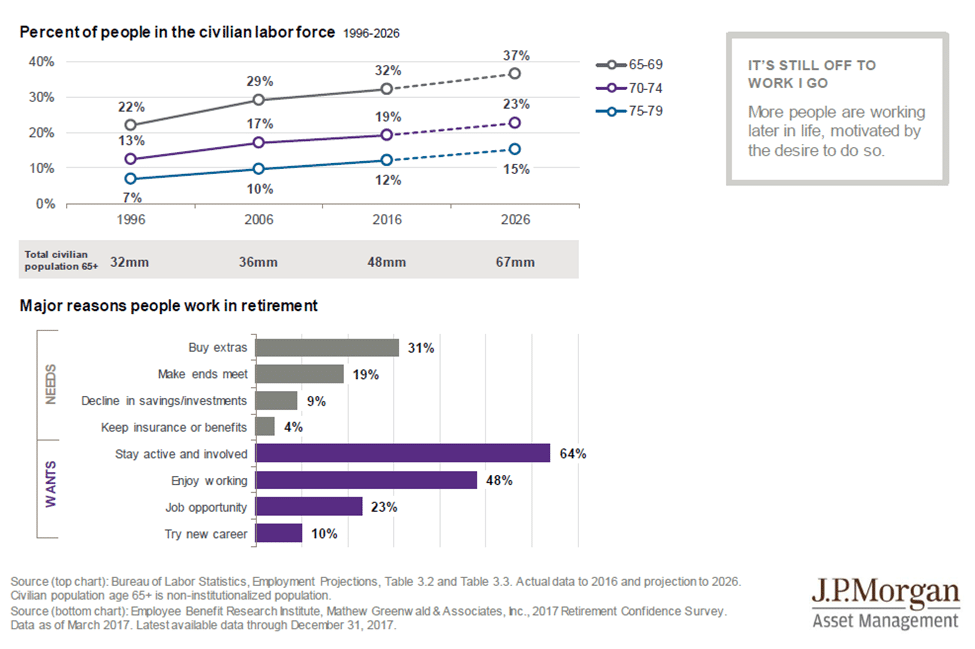

For example, the chart below illustrates the increasing number of people staying in the workforce. The second chart takes it a step further and indicates that “stay active and involved” is by far one of the top reasons people work in retirement.

As some of you know, I was a competitive collegiate swimmer, so let’s use a competitive swimming analogy to illustrate. When a swimmer has a great race, they prepared physically and mentally before the race ever began. In a word, they “practiced”. Although you can’t “practice” for retirement, you can “practice” envisioning what you want your retirement to look like and prepare accordingly. Do you want to stay in the work force and do something fun? Do want to travel the world? Do you want to downsize your home? Do you want to take care of grand kids? Do you want to start a new hobby? Do you want to serve others? By mentally going through these specific situations, you will be in a much better position to make financial planning decisions along the way. You will be thinking about retirement in real terms instead of in the abstract, and just like the best swimmers, you will be well-prepared to win your retirement race.