6 Facts Regarding Oktoberfest and 5 Facts Regarding the Stock Market in October Many of us love...

When you retire, it’s nice to have income options, and focusing on building those income options is a sound part of a retirement plan. You are probably most of the way there, and you don’t even know it! Income options include tax-deferred income, tax-free income, and guaranteed income. Tax deferred income comes from your 401k and/or IRA accounts. Tax-free income comes from your Roth IRA.** Guaranteed income can come from an annuity, a pension, and/or Social Security.***

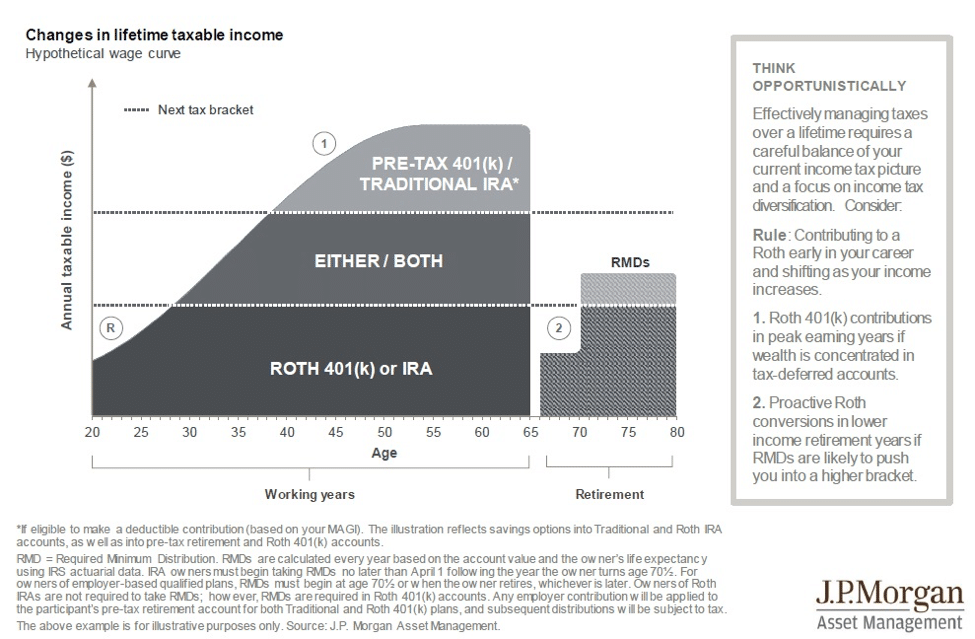

Effectively managing taxes over a lifetime requires a careful balance of your current income tax picture and a focus on income tax diversification. The answer to evaluating a Roth is to think opportunistically.

As a general rule, you should contribute to a Roth early in your career and shift to tax deferred vehicles as your income increases. This is represented by the circled R on the chart below. Over the years, as your income increases, if your wealth becomes concentrated in tax deferred accounts, you could direct funds to a Roth 401k (if it’s available to you). This is represented by the circled 1 on the chart below. Finally, as you reach your early retirement years, you could switch to proactive Roth conversions especially if your Required Minimum Distributions are likely to push you into a higher bracket. This is represented by the circled 2 on the chart below.

As you can see, managing your income options in retirement and tax planning go hand in hand, and we are here to help! Please contact us so that we can help you build your retirement income options.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual, nor intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

* Withdrawals from IRAs are subject to income taxes, and if made prior to age 59 1/2, a 10% penalty tax may apply

**The Roth IRA offers tax deferral on any earnings in the account. Withdrawals from the account may be tax free, as long as they are considered qualified. Limitations and restrictions may apply. Withdrawals prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Future tax laws can change at any time and may impact the benefits of Roth IRAs. Their tax treatment may change. Traditional IRA account owners should consider the tax ramifications, age and income restrictions in regards to executing a conversion from a Traditional IRA to a Roth IRA. The converted amount is generally subject to income taxation.

***Annuity guarantees are based on the claims paying ability of the issuing company