I am sharing with you some of the information the Life Insurance Marketing and Research...

Is the 4% distribution rule outdated?

There are many “rules” in the investment arena but none receiving more media critics than the 4% Safe Withdrawal Rate (SWR). Back in 1994, Bill Bengen published the SWR, which concluded that you were safe if you could keep your distributions during retirement at 4% or lower. Safe meant that you wouldn’t erode your principal if you limit yourself to a 4% distribution rate. Obviously, if you are okay with eroding principal some to live the lifestyle you want, this rule is conservative.

What many don’t know is that the 4% bar was in reality the worst case distribution rate from 1925 to 1998 (although it was first published in 1994, he updated his study in 1998).

Interesting enough, the 4% rule is really what withdrawal rate you could have taken in the 1970s when we had high inflation and erratic stock price movements.

Recently both the New York Times and The Wall Street Journal have proclaimed the 4% rule dead due to the current environment in the bond/fixed income arena. Yields on most fixed income investments are closer to the historical lows than their averages.

The issue I have with these studies is that they aren’t clear enough on the fact they are a rule based on historical data, which may or may not repeat.

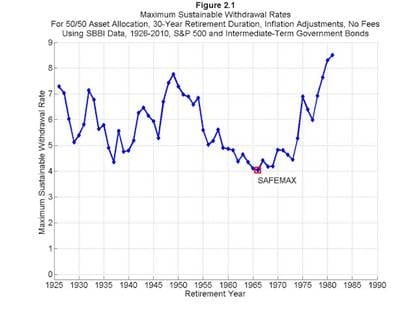

Regardless of this fact, if you look closely at the Bengen study as well as a study done by Harvard regarding their endowment fund, the 4% doesn’t seem so unreasonable. Following is a chart published by Bengen that shows the maximum SWR.

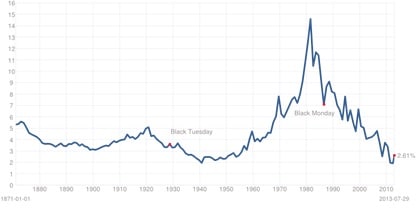

Now let’s look at the chart for the 10 year U.S. Government Bond yield

You can see that the yield was between 2% to 3% from the mid 1930s to the late 1950s. At the same time the SWR ranged from, with a few exceptions, 5% to 8%. The 10 year yield moved up significantly from 1960 to the early 1980s. What do many people expect to happen to yields going forward? The fear is higher rates. During the tough times for bond values (bond prices drop historically when interest rates rise) in the mid 1960 to early 1980, the SWR dropped to the low 4% range. Only during that period did we have a SWR as low as 4%.

Back to the important fact to consider, this is all based on historical data that may or may not repeat itself. What if we go through an extended deflationary period? Even scarier would be stagflation, a period in which you have minimal to no economic growth but high inflation?

Based on what we know and can surmise from the studies, a 4% SWR doesn’t seem so unreasonable. However, it is my position the only sure way to reach one’s goals and keep their principal intact, excluding those that can take a distribution rate of 2%, is flexible spending. We like to plan in ranges of spending. If a couple can lower their spending to a bottom range during the tougher years in the market and vice versa in the better years, they increase the probability of success significantly.