I am sharing with you some of the information the Life Insurance Marketing and Research...

How did your portfolio stand-up to COVID-19 in March? Were you down 30% with the market? Were you comfortable with the volatility? Were you okay with your downside exposure or did you have a pit in your stomach? Did you stay the course? Have you recovered?

If you were uncomfortable with the downside your portfolio experienced in the first part of 2020, it may be time to revisit the risk and adjust accordingly. Do you know how much risk you are taking? Do you know how much you are limiting your upside by limiting your downside and vice versa?

At Virtus Wealth Management, we use a systematic approach to quantify and test your risk tolerance. We then take that information a step further and use it to design and manage your portfolio. We believe that understanding objective drawdown limits and ranges of return possibilities help us help our clients to understand the financial impact of risk and set expectations.

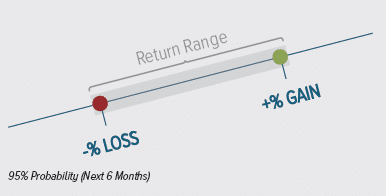

Investment returns are not linear. While any portfolio may have an average annual historical return, every year is different. When a portfolio is on its intended track, the expectation for any rolling time frame, for example, the next six months, should have a range of returns from negative to positive.

Are you concerned about the lasting effects of this pandemic? Do you know how much risk you are taking in your portfolio? Do you want to better understand the downside / upside risk relationship to quantify the risk that you are willing to take to reach your goals? We are here to help! Please contact us today for a consultation.

The information provided here is for general information only and should not be considered an individualized recommendation or personalized investment advice.

All investing involves risk including loss of principal.

No strategy assures success or protects against loss.

Past performance is no guarantee of future results.