We at Virtus Wealth Management take pride in offering multiple services through all stages of...

I was meeting with a client the other day and we were discussing expectations. This couple is fairly risk averse but they have reasonable expectations of just 5% returns per year. Luckily, they aren’t the type that wants 0 risk but 10% returns. They do have one requirement in which less than 40% of their investments can be in stocks. The husband is most worried about the risk of the stock market. I informed him that my biggest challenge in meeting his expectations right now is the large bond portfolio, not stocks.

“Stocks are short-term risky but long-term safe while bonds are short-term safe but long-term risky.”

Larry Fink, Blackrock CEO

It is important to understand the relationship between interest rates compared to fixed income investments like bonds, CDs, and cash. Bottom line, it is an inverse relationship. Historically, when interest rates move up, the value of a fixed income investments decreases. It is very logical. If you own a bond paying 2% interest but current market rates move to 4%, why would someone buy your bond paying 2% when they can get 4% on the street? You would need to sell your bond at a discount so it equals a 4% yield for the buyer.

Thus, there is this catch-22 paradox for risk averse investors in this market. The more risk averse you get, the more you might actually lose in this market long-term. I don’t think it is reasonable to expect interest rates to drop materially from where we are today. The two more likely scenarios are interest rates stay flat or increase. If they stay flat, one becomes a “coupon clipper.” A term derived from nonbearing bonds when you would actually clip off a coupon and tender it for interest payments. Used in the context of my article, you can expect to make money on the interest due but none of the value of the investment increasing. Compared to when interest rates are dropping, in which you can make money on the interest and the value of your bond due to it increasing (recall the inverse relationship).

If interest rates rise, then it is worse news for those investments because you still earn the interest but the value of your bond is decreasing. The amount you lose depends on the speed of the increase in rates.

The double whammy is inflation. In reality, inflation means you aren’t making as much money on your fixed income portfolio as you think. If inflation is 2% and you earn 2%, then really your car is in neutral going nowhere. If inflation is higher than the interest you earn (CDs currently), then you are actually going backwards. You might not think you are losing money but you are losing buying power in this example.

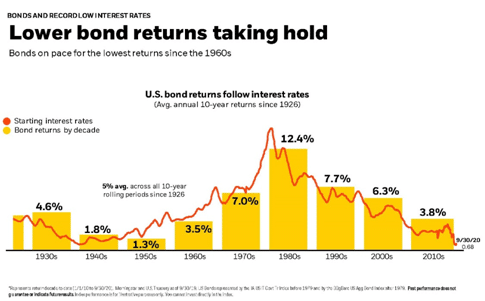

Let’s look at history. The following chart goes back to the 1930s and shows how U.S. bonds performed in environments in which rates rose or dropped.

You can see that rates (red line) hit lows in the early 1940s. Over two decades, from 1940 to 1960, U.S. bonds made approximately 1.5% annually. In 12 of those years, inflation (using CPI) was higher than 2%, and in many cases by much more. For example, in 6 of the years inflation was over 5%, hitting a high of 18% in 1946. Real returns, which is returns net of inflation, were actually negative over those two decades.

It is important to note here, I am not suggesting that people remove all bonds from their portfolio. Bonds are still a great risk mitigator for the market. There are also bonds that do better in a rising interest rate environment. I will save discussing those types of bonds for another article. If you want to know before then, please feel free to give me a call. Also, be careful with many of those types of bonds because they can be very correlated to stocks. They might not be as safe as you want. What I am suggesting is understanding what you should expect if you decide to be very conservative.

Finally, if many investors can’t make their return they need in bonds, where do you think they are putting their money? Valuations are always important but they must factor in market interest rates.

In summary, please make sure you understand exactly what you are signing up for when you want to be very conservative or if you have a significant amount of money in CDs. Fear might be costing you significant buying power longer-term. The hardest thing for a retail investor to do is take the emotions out of investing.