I am sharing with you some of the information the Life Insurance Marketing and Research...

Millennials have been credited with ruining the English language. For example, in 2013 the definition of the word ‘literally’ was updated to include “in a figurative sense, the exact opposite of the original meaning” inciting an uproar among news outlets. In this article I won’t place any blame or dig any further into what millennials have or have not done, but instead want to talk about this phenomenon that is semantic bleaching.

Semantic bleaching is the reduction of a word’s intensity and sometimes its original meaning as it becomes rapidly and consistently overused. Such words as “literally” have literally been so consistently overused that not only has the intensity of the word lessened, the definition of the word has been altered to mean the exact opposite of its original meaning.

Now in marketing and writing there are trendy “buzzwords” that help reflect topics that currently garner the most attention and readers – words such as “millennials” (get what I did there?). When caught in the upswing of their trend, these words attract more viewers to websites and newsletter articles, but then they become oversaturated and essentially meaningless due to semantic bleaching. Our firm has recently paid attention to our industry’s latest buzzword: “financial freedom”.

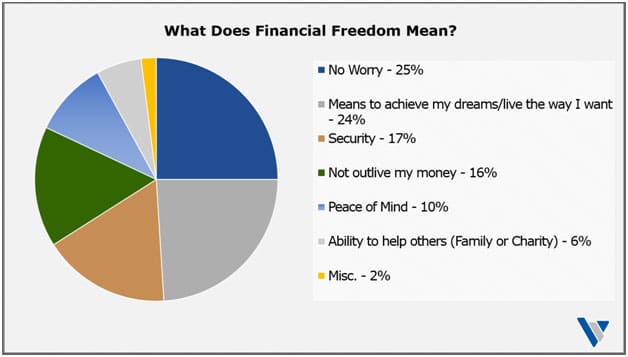

The term “financial freedom” is rapidly growing on the websites and promotional material of financial advisors nationwide. So, before it becomes the next ‘literally’ and loses its magnitude and original meaning, we decided we should ask our readers what financial freedom meant to them. This question was included on our latest questionnaire, which we mailed in March of this year. Here is a summary of the response we received:

It is interesting to note that there was not one clear, unified answer. The term meant vastly different things to different people. In February Karen wrote an article for our Virtus View, which mentioned that 84% of those who defined their savings goals were able to save money and that those who set a goal were more likely to save than those who did not. If terms like financial freedom or peace of mind are one of your financial goals, what does that actually mean to you? Can you envision what achieving these financial goals will look like? It is unfair to you to have set goals based on “buzzwords” from financial media if there is not a clear understanding of what and how that goal can be achieved.

As your life changes so do your plans and goals. If you believe your financial goals have changed or become less clear, talk with your financial advisor – we’re here to help. Or if you are just beginning to set financial goals, no matter your age or income, a financial advisor is a great place to start.