I am sharing with you some of the information the Life Insurance Marketing and Research...

Tell us your goals, and we’ll tell you your number. When do you want to retire? How much do you want to spend? How much risk do you want to take? Let’s do this.

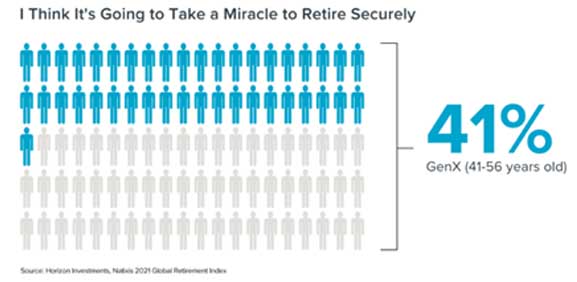

Sadly, 41% of GenXers agreed with the statement that “given certain challenges, it’s going to take a miracle to retire securely,’’ according to the 2021 Natixis Global Retirement Index. GenXers are my people (born 1965-1980), and this statistic is obviously unacceptable.

There are challenges ahead like:

These worries are understandable and that’s exactly why goal-based financial planning is important. It may not take a miracle, but it will take a plan! We are here to help. According to DALBAR, Inc., 73% of clients who work with an advisor said they have an estimate of what they’ll need for retirement versus 45% of those who are going it alone.

Our Connect Wealth Process will help us help you connect all of the financial pieces of your life together, gain synergy, give you hope, and develop a plan so you know what to do to make your retirement dreams a reality. No miracle required.

Call us today at 866-407-4320 to learn more about our services and how we can help you.